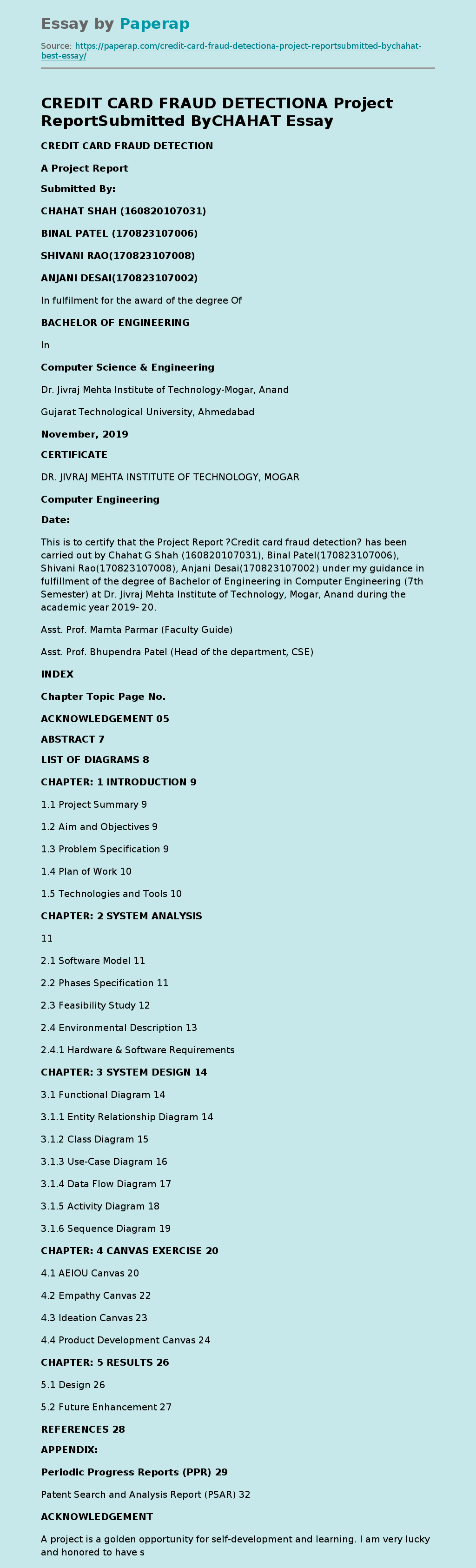

CREDIT CARD FRAUD DETECTIONA Project ReportSubmitted ByCHAHAT

CREDIT CARD FRAUD DETECTION

A Project Report

Submitted By:

CHAHAT SHAH (160820107031)

BINAL PATEL (170823107006)

SHIVANI RAO(170823107008)

ANJANI DESAI(170823107002)

In fulfilment for the award of the degree Of

BACHELOR OF ENGINEERING

In

Computer Science & Engineering

Dr. Jivraj Mehta Institute of Technology-Mogar, Anand

Gujarat Technological University, Ahmedabad

November, 2019

CERTIFICATE

DR. JIVRAJ MEHTA INSTITUTE OF TECHNOLOGY, MOGAR

Computer Engineering

Date:

This is to certify that the Project Report ?Credit card fraud detection? has been carried out by Chahat G Shah (160820107031), Binal Patel(170823107006), Shivani Rao(170823107008), Anjani Desai(170823107002) under my guidance in fulfillment of the degree of Bachelor of Engineering in Computer Engineering (7th Semester) at Dr.

Jivraj Mehta Institute of Technology, Mogar, Anand during the academic year 2019- 20.

Asst. Prof. Mamta Parmar (Faculty Guide)

Asst. Prof. Bhupendra Patel (Head of the department, CSE)

INDEX

Chapter Topic Page No.

ACKNOWLEDGEMENT 05

ABSTRACT 7

LIST OF DIAGRAMS 8

CHAPTER: 1 INTRODUCTION 9

1.1 Project Summary 9

1.2 Aim and Objectives 9

1.3 Problem Specification 9

1.4 Plan of Work 10

1.5 Technologies and Tools 10

CHAPTER: 2 SYSTEM ANALYSIS

11

2.1 Software Model 11

2.2 Phases Specification 11

2.3 Feasibility Study 12

2.4 Environmental Description 13

2.4.1 Hardware & Software Requirements

CHAPTER: 3 SYSTEM DESIGN 14

3.1 Functional Diagram 14

3.1.1 Entity Relationship Diagram 14

3.1.2 Class Diagram 15

3.1.3 Use-Case Diagram 16

3.1.4 Data Flow Diagram 17

3.1.5 Activity Diagram 18

3.1.6 Sequence Diagram 19

CHAPTER: 4 CANVAS EXERCISE 20

4.1 AEIOU Canvas 20

4.2 Empathy Canvas 22

4.3 Ideation Canvas 23

4.4 Product Development Canvas 24

CHAPTER: 5 RESULTS 26

5.1 Design 26

5.2 Future Enhancement 27

REFERENCES 28

APPENDIX:

Periodic Progress Reports (PPR) 29

Patent Search and Analysis Report (PSAR) 32

ACKNOWLEDGEMENT

A project is a golden opportunity for self-development and learning. I am very lucky and honored to have so many wonderful people support me and lead me through in completion of this project.

I acknowledge the support, the encouragement and the immense guidance extended for this study by my internal guide Asst.

Prof. Mamta Parmar mam.

I greatly appreciate the motivation, understanding and mentoring extended for the project work by Asst. Prof. Bhupendra Patel Head of Dept., Dr. Jivraj Mehta Institute of Technology-Mogar for their kind supportive help and suggestions.

Finally, I would like to say my heart full in debtedness and owe a deep sense of gratitude to all the teaching and non-teaching staff of CSE department, Fellow classmates and my dearest family for their timely support and suggestions.

-Chahat Shah(160820107031)

-Binal Patel(170823107006)

– Shivani Rao(170823107008)

-Anjani Desai(170823107002)

ABSTRACT

In todays digital era credit card is pretty common. Because of large number of credit card users number of transactions are also very large. It is very difficult to detect frauds in the transactions. It would be impossible to do such a task manually. In this case machine learning and data mining approach; we can train the model with the available data that would be used to perform future detection of frauds in credit card transactions.

List of Diagrams

Figure 1 E-R Diagram 14 Figure 2 Class Diagram 15 Figure 3 Use-Case Diagram 16 Figure 4 DFD (Level-0) 17 Figure 5 DFD (Level-1) 18 Figure 6 Activity Diagram 19 Figure 7 Sequence Diagram 21 Figure 8 Empathy Canvas 22 Figure 9 – Ideation Canvas 23 Figure 10- Product Development Canvas 25 Figure 11 – AEIOU Canvas 20

CHAPTER: 1 INTRODUCTION

1.1 PROJECT SUMMARY

In this digital era credit card is pretty common. Because a large number of credit card users number of transactions are also very large. It is very difficult to detect frauds in the transactions. It would be impossible to do such a task manually. In this case machine learning and data mining approach we can train the model with the available data that would be used to perform future detection of frauds in credit card transactions. In the first step, we will perform an experiment with available machine learning algorithms. In the second step according to the accuracy, precision, and recall and also with the help of confusion matrix we will select the best algorithm for future predictions of frauds in the transactions of the credit cards. In the third step we will try to build web-based GUI using python Flask to detect frauds in the transactions.

Our main objective is to create GUI based as well as User-friendly system to detect fraud in credit card transactions with higher accuracy and in the less time with the help of machine learning techniques. Now a days sufficient resources are available as well as powerful machine learning algorithms and data are also available to predict any task. So we are going to detect faulty transactions of the credit card we help of available transaction data.

1.2 AIMS AND OBJECTIVES

The main aim of the project is to detect the fraud in credit card with higher accuracy using GUI and user friendly approach.

Our main objective is to create GUI based as well as User-friendly system to detect fraud in credit card transactions with higher accuracy and in the less time with the help of machine learning techniques. Now a days sufficient resources are available as well as powerful machine learning algorithms and data are also available to predict any task. So we are going to detect faulty transactions of the credit card we help of available transaction data.

1.3 PROBLEM SPECIFICATION

The detection of faulty transactions in credit card.

1.4 PLAN OF WORK

In this digital era credit card is pretty common. Because a large number of credit card users number of transactions are also very large. It is very difficult to detect frauds in the transactions. It would be impossible to do such a task manually. In this case machine learning and data mining approach we can train the model with the available data that would be used to perform future detection of frauds in credit card transactions. In the first step, we will perform an experiment with available machine learning algorithms. In the second step according to the accuracy, precision, and recall and also with the help of confusion matrix we will select the best algorithm for future predictions of frauds in the transactions of the credit cards. In the third step we will try to build web-based GUI using python Flask to detect frauds in the transactions.

1.5 TECHNOLOGIES AND TOOLS:

Python Programming

Different Machine Learning Libraries

GUI python library: Tkinter

Web Based Development : Python-Flask

4 Algorithms (Random Forest, Isolation Forest, Decision Tree, Deep learning)

CHAPTER: 2 SYSTEM ANALYSIS

2.1 SOFTWARE MODEL

Our Project is being developed using specific software development life cycle. Software development approach is best suited for the project depends on the requirements and other factors. A process model is a development strategy that is used to achieve a goal that satisfies the requirements biding by the constraints.

There are many types of Software Process Models like:

Waterfall Model

Iterative Model

Incremental Model

Spiral Model

We have used the spiral model.

? Software Process Model

Software engineering is the establishment and use of engineering skills in order to obtain economical software that is reliable and works efficiently on real machines. Whenever you build any product or system, its crucial to go through a series of predictable steps i.e. a road map that helps you creates a timely, high-quality result. The road map here refers to is called a software process.

The spiral model, was invented by Boehm which was an evolutionary software process model that tie the iterative nature of prototyping with the controlled and systematic aspects of the linear sequential model.

Customer communicationTasks required to establish effective communication and efficient transactions between developer and customer.

Planning Tasks required to define resources, timelines, and all the other project related information to effectively plan the project work.

Risk analysisIt is the essential task which requires to evaluate both technical and management risks for making the project better.

EngineeringTasks here requires to build one or more than one representations of the application.

Construction and releaseTasks here refers to the requirement to construct, test, and install (e.g., documentation and training).

With changing of requirements of user like product ordering on bases on numbers of hours worked, other improvement in project management or other matters sagest us to use spiral model. Customer also makes us to change the business logic which is the most critical factor of the system and it raises the risk factor of the system.

The spiral model is the most useful model for the risk management. The spiral model is also the evolutionary model so it can best handle the changing requirements of member.

2.2 PHASES SPECIFICATION

? Data Gathering Phase

? Data Visualization Phase

? Pre Processing or Cleaning Phase

? Model Building Phase

? Training and Testing

? Model Validation

? Model Deployment Phase

2.3 FEASIBILITY STUDY

Feasibility study is conducted once the problem is perceptibly understood. The aim of feasibility is not only to solve the problem but to determine if the problem is worth solving.

The overall scope of the feasibility study was to provide sufficient information to allow a decision to be made as to whether the ?Credit Card Fraud Detection project should proceed and so, its relative priority in the context of the other existing system.

The system has been tested for feasibility depending upon the below mentioned types:

1. Technical Feasibility

The project entitles ?Credit Card Fraud Detection is technically feasibility because of below mentioned feature. The project was developed in Python and ML with Graphical User Interface.It provides the high level of availability, compatibility and reliability. All these make Python an appropriate language for these project.

2. Economical Feasibility

The Credit card fraud detection can be detect easily and freely.

3. Operational Feasibility

In this project, users can get all possible help from our GUI or Web application.

2.4 ENVIRONMENT DESCRIPTION

?Credit Card Fraud Detection is effective when the correct software application and hardware configuration is used.

2.4.1 HARDWARE AND SOFTWARE REQUIREMENTS Hardware Requirements:

Server :Local server and online server.

Device :Laptop , Desktop

Software Requirements:

Operating System : Any OS Windows/Linux/Mac Front End : Python Programming/Tkinter

Back End (Database) : Python Flask/ ML Library/ 5 Algorithms.

Web Browser : Any browser Internet

CHAPTER: 3 SYSTEM DESIGN

3.1 FUNCTIONAL DIAGRAMS

3.1.1 E-R DIAGRAM

In software engineering, an entityrelationship model (i.e. ER model) is referred as data model for narrating the data or information aspects of a business domain or its process requirements, in an abstract way that lends itself to ultimately being implemented in a Database. ER model popular for conceptual design .Constructs are expressive, close to the way people think about their applications.

3.1.2 CLASS DIAGRAM:

Class Diagram under the UML (Unify Modeling Language) are very important and are used to display the static view of the system. Generally class diagram represents how to put various objects collectively.

3.1.3 USE-CASE DIAGRAM:

Use case diagram is a UML diagram which has actors and use cases showing the goals of th user . The use case modeling approach keeps software development team focused on what user wants to do rather than what features is going to develop. Use case diagram provides a crystal clear presentation for system analyst to see all user goals and related end-users (actors).

3.1.4 DFD DIAGRAM:

A DFD is a network that describes the flow of data and the processes that change, or transform, data throughout a system. This network is constructed by using a set of symbols that do not imply a physical implementation.

It has various levels to indicate the process deeply , incrementally in every next level.

For eg DFD Level-0 (Context Digram), DFD Level-1, DFD Level-2. It is not UML Diagram. DFD illustrates how data flows through the system.

3.1.5 ACTIVITY DIAGRAM:

3.1.6 SEQUENCE DIAGRAM:

The Sequence Diagram shows how the objects interaction with each other and also represent the sequence of activities or event. Sequence Diagram is a time-oriented view of the interaction between object to accomplish behavioural goal of the system.

CHAPTER: 4 CANVAS EXERCISE

Canvas exercise includes various canvases to be prepared and filled with our collected and processed data.

These canvases are as listed below:

? AEIOU Canvas

? Empathy Canvas

? Ideation Canvas

? Product Development Canvas

The journey of obtaining the information performing observations and inputting data into these defined canvases was a complex process. Details of each canvas are separately described to give justice to all the aspects of each canvas.

4.1 : AEIOU Framework

This exercise was to perform observations and deduct information from them relating to the provided frameworks. The whole summary of this exercise can be seen in the provided image.

4.1.1 : AEIOU Activity

This framework was to include the activities that the user is likely to perform while having the need of our product.

4.1.2 : AEIOU Environment

This activity referred to the environments in which the users are most likely to use our product.

4.1.3 : AEIOU Interaction

This observation required us to focus on the interactions that the user is undergoing or will undergo while performing the activities, described in the previous framework.

4.1.4 : AEIOU Object

The objects that are used or have some effect on the actions of the users during the mentioned interactions and activities are listed in this framework. This observation was important to understand the place where our product can fit in, in relation to the activities and functionalities it can be utilized for.

4.1.5 : AEIOU User

This last framework activity was to understand the users that we are going to target.

These include students, children, common man, sports person and police officers as well.

4.2 : Empathy Mapping Canvas

The first point to be decided in this canvas was the USER. Who will be the user for our project/product?

The next reference is made for the peoples or authorities that directly or indirectly play some role in the lives of the users defined. These are called stakeholders. They somewhat effect the decisions and actions of the user taken under certain situations. They also have major part in interacting with the user in multiple situations and circumstances.

The next list was of the activities that our declared user is likely to perform. They were listed out with the place and use of our product. These activities can, in one way or another, result in the use of our product.

Following it up in our empathy canvas exercise we had to put ourselves in the shoes of our users and develop stories referring to two Happy and two sad moments in their lives. This included in empathizing the users and understanding their emotions to better understand their requirements and expectations from our product. This exercise helped us in understanding the important aspects of our product and also guided us in defining strong requirement criterias.

4.3 : Ideation Canvas

Now this canvas exercise was to focus on the idea of our project. The end result for this was to get a clear idea about the product that we will develop and the general uses that can be related to it. We defined all the probable users that have a chance of utilizing our product.

4.4 : Product Development Canvas

This development canvas exercise was the real implementation of all of our observations and deductions. The final evaluation and concept of our product design are explained in this canvas. Describing the presented sections of this canvas in brief as per the order in which they were noted.

Purpose: This section was to declare the purpose of our product. For this we mentioned the main purposes for which the end product will relate to.

People: After purpose of our product, we defined the peoples that will use our product. These were the ones who are going to use our product comparatively more than others.

Product Experience: This was the section in which the experiences that we plan to provide the users are described.

Product Function: The major functions that we want our product to provide.

Components: The components that will be included in our product are listed in this section. These components are mainly the ones which will be working or have important significance in the operation of the product.

Customer Revalidation: Now we presented our processed data and idea in front of a selected group of people to get the validation of our defined problem and its solution. The reviews that we got were really useful and presented with a new set of requirements and challenges that needed to be met in order to provide the mentioned customer experience.

Redesign, Reject, Retain: These were the options that we had to improve on. The details that the revalidation from the users provided helped in changing a few concepts and plans for our product.

CHAPTER: 5 RESULTS

5.1 Designs

1) First look

2) Login Page

3) Admin Panel

4) Chatbot

5.2 Future Enhancements

GUI approach

REFERENCE

www.project.gtu.ac.in

APPENDIX

I. Periodic Progress Reports (PPR)

II. Patent Search and Analysis Report (PSAR)

1) PPR

2) PSAR

CREDIT CARD FRAUD DETECTIONA Project ReportSubmitted ByCHAHAT. (2019, Nov 18). Retrieved from https://paperap.com/credit-card-fraud-detectiona-project-reportsubmitted-bychahat-best-essay/