Britvic Plc Financial Analysis

1. Aim

The aim of the following report is to assess the financial activity of Britvic PLC over a sixty months period, from January 2005 until December 2009, in order to make recommendations for a future investment in the company.

2. Company overview

Britvic PLC was founded in 1938, in Chemsford, under the name of British Vitamin Company Products, from which it takes its name and has been the first company to launch fruit juice in baby bottles. Barely in 1971, the company became known as we know it today, changing its name to Britvic PLC.

Nowadays, Britvic PLC is, according to their website, one of Europe’s leading companies in the soft drinks industry, trading in over fifty countries across Europe, amongst which we may enumerate Great Britain, Ireland and France and possessing a brand portfolio which comprises names, such as Robinsons, Drench, and, from 2010, Fruite. Moreover, Britvic PLC owns bottling agreements with PepsiCo in the United Kingdom, for the brands Pepsi and 7UP. According to the website www.

stifel. com, a company’s size is defined by its market capitalization, alongside its physical size, described by its number of factories, employees.

Britvic Plc had in the past five years an average number of employees of 3500, working in the company’s twelve factories to produce approximately 1. 9 billions of litres of soft drinks that generated sales of 755000, on average, with a maximum of 978,800, reached in 2009. In terms of market capitalization, the mean revolves around 535,250, the peak being achieved in 2009, with almost 200000 over the mean. Therefore, it may be stated that Britvic plc is one of the largest companies trading on United Kingdom’s soft drinks market.

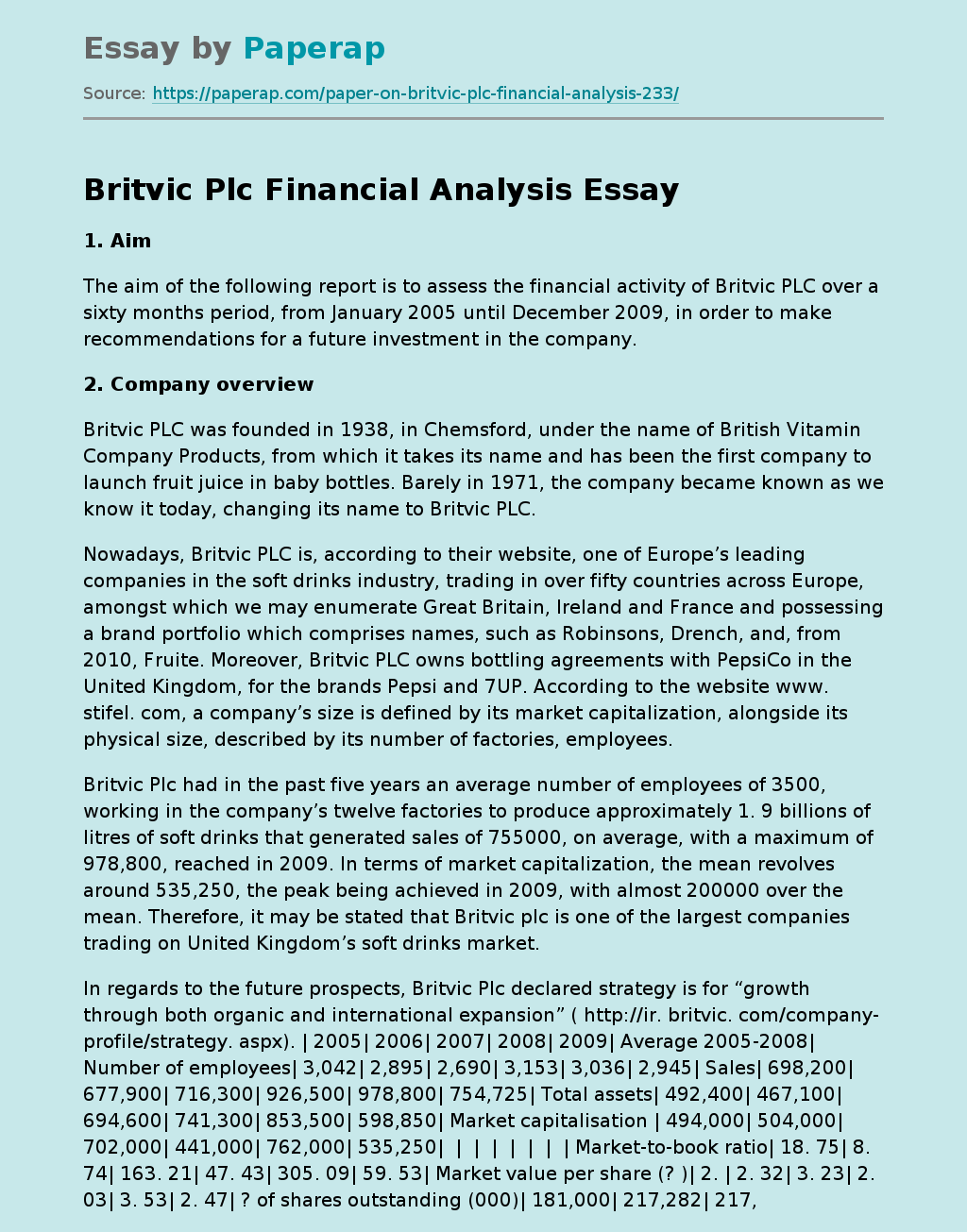

In regards to the future prospects, Britvic Plc declared strategy is for “growth through both organic and international expansion” ( http://ir. britvic. com/company-profile/strategy. aspx). | 2005| 2006| 2007| 2008| 2009| Average 2005-2008| Number of employees| 3,042| 2,895| 2,690| 3,153| 3,036| 2,945| Sales| 698,200| 677,900| 716,300| 926,500| 978,800| 754,725| Total assets| 492,400| 467,100| 694,600| 741,300| 853,500| 598,850| Market capitalisation | 494,000| 504,000| 702,000| 441,000| 762,000| 535,250| | | | | | | | Market-to-book ratio| 18. 75| 8. 74| 163. 21| 47. 43| 305. 09| 59. 53| Market value per share (? )| 2. | 2. 32| 3. 23| 2. 03| 3. 53| 2. 47| ? of shares outstanding (000)| 181,000| 217,282| 217,282| 217,282| 216,067| 208,212| | | | | | | |

3. Short-term assets management

In order to analyse the efficiency of Britvic PLC, it is recommended to calculate the short-term assets management ratios, like the debtors’ days, the creditors’ days and the stock’s days. Atrill defines the stock days as the average period for which inventories are held. Britvic PLC held its stock in 2009 for 48 days, with 10 days less than the average for the 2005-2008 period, timeline in which the maximum recorded was in 2007 and had the value of 69 days.

A reduction in this ratio was firstly observed in 2008, when the stock was held for only 47 days. Consequently, it may be stated that Britvic PLC improved its trading performance by increasing the number of transactions taking place in one year time, increase derived from a smaller number of days in which the stock is held by the company. The debtors’ days are described by Atrill as the amount of time in which credit customers pay their debts to the business.

In 2009, the debtors’ days ratio for Britvic PLC was of 54 days, with 4 days bigger than the average for the timeline between 2005 and 2008. Britvic PLC was compelled in 2007 to increase with approximately 10 days the period in which credit customers pay their liabilities, so that the impact of economic recession over the organisation’s profit was reduced by maintaining the drop in the level of sales at an acceptable level. One year later, in 2008, an 8 days decrease in his ratio was recorded, followed by a 2 days increase in 2009.

As reported by their financial statements, the debtors’ days ratio has been stable for the past two years, a sign of recovery after the economic recession, but not as low as in the economic boom, characteristic for the 2005-2006 period. The third ratio mirroring the company’s efficiency is the creditors’ days ratio, which measures, according to Atrill, the number of days in which the business pays its debts to suppliers. Britvic PLC’s financial statements recorded in 2009 a 20 days increase in the above mentioned ratio compared to the 2005-2008 average that had a value of 149 days.

Therefore, Britvic PLC paid in 2009 its debts 169 days after the enclosure of the transactions. Taking into consideration the fact that Britvic PLC is operating in the soft drinks industry, which has a medium pace of generating cash, it may be stated that this ratio’s value is high enough to reflect that Britvic PLC is risking the creditors’ goodwill. On the other hand, the company paid its short-term liabilities in approximately four months after receiving the supplies for the past five years, which may mean that tis period has been previously agreed with the creditors, situation in which Britvic I not taking any unnecessary risks.

The figures in the three ratios analysed above resulted in a negative operating cash cycle, which means that Britvic PLC is holding cash in hand in between transactions. The business receives money from its debtors long before paying its creditors, creting a time window in which the company may use the money for other puposes, such as to serve their expasionist policy. 4. Liquidity In order to examine the company’s liquidity, two solvency ratios are to be examined: the current ratio and the quick ratio.

The current ratio measures the current assets against the current liabilities, while the quick ratio measures only the liquid assets, cash in hand and all belongings quickly convertible into cash, against the current liabilities. Britvic PLC’s current ratio had a stable value over the past five years, the average revolving around 0. 9, value that falls behind the ideal figure of 2 set by most authors, including Atrill and McLaney. The average for the quick ratio has as well a smaller value than the ideal unitary figure, the mean of the ratio during the five years period been of 0. 2. When assessing a company’s solvency, it is wisely to take into considerations the conditions set by the industry in which it is operating. As previously said, Britvic PLC is operating in an industry with a medium velocity of generating cash and, consequently, its quick ratio should have a value no smaller than one in order to pay its short-term debtors in the case of them requesting a quick payment without endangering the company’s financial situation and reputation.

The values of the quick ratio correlated to the figures of the creditors’ days ratio over the past five years underline Britvic PLC’s policy regarding its liabilities: “The objective of the group’s liquidity policy is to maintain a balance between continuity of funds and flexibility through the use of bank loans and overdrafts” (Britvic PLC’s financial report 2009, pg. 82). This policy is the main reason for a negative operating cash cycle, as well as for a sub unitary value of the quick ratio.

5. Profitability

The authors of the book “Fundamentals of corporate finance” suggest three measures to be reviewed when analysing an organisation’s profitability: the profit margin, the return on assets and the return on equity. Based on a prior financial evolution of the company, these three ratios measure the profit generated by the business against other financial components. The profit margin for Britvic PLC was in 2009 of 6. 76, registering a drop of 0. 22 compared to the 2005-2008 average. This ratio underlines the fact that over a five years period, Britvic PLC made on average a little less than 7p for every pound in sales.

The main cause for the drop in the profit margin may be considered the constant increase in sales that causes the profit margin to shrink when correlated to a stability of the sales price. Moreover, if the mean of the sales over the same period is to be considered as been of over 850 millions, it may be stated that Britvic PLC is one of the most profitable companies in British soft drinks industry. The return on assets is a measure of profit per pounds of assets. In the particular case of Britvic PLC, the average for the period between 2005 and 2008 is of 8. 6, meaning that for every pound worth of asset, the business generated approximately 9 p of profit, while in 2009, the financial statements of the company recorded a 1. 2 drop in this ratio, due to the purchase of the French Fruite Enterprise. Nevertheless, the most important ratio reflecting the company’s profitability from an investor’s point of view is the return on equity, which a measure of profit made by the actual investors. The calculations based on Britvic PLC’s financial statements report that the shareholders earned in 2009 more than ? 8 for each pound invested in the company and between 2005 and 2008 an average of ? 4. This average value of 1131. 97 of this ratio over the past five years mirrors Britvic as a very profitable investment. On the other hand, before drawing early conclusions, it is advisable to conduct an intricate analysis of the company’s prior performance and present financial structure, which is aimed to result in as accurate as possible future predictions regarding the profitability of an investment in Britvic PLC’s shares.

6. Financial structure and cost of capital

The first step is to investigate Britvic PLC’s financial structure and cost of capital, past performance and decisions being valuable indices of the risk and returns of a future investment. The overall debt management policy is to „safeguard the group’s ability to continue as a going concern and maintain an appropriate capital structure to balance the needs of the group to grow, whilst operating with sufficient headroom within its bank covenants” (Financial statement 2009 – pg. 93).

The average total debt ratio for the past five years is 5. 67, meaning that for every pound of assets Britvic PLC has 5. 67 pounds in debt. Taking into account the company’s debt policy, this ration has an appropriate value as to ensure the company uses great part of their debts. As a direct consequence of their debts policy, Britvic PLC is considered by the market a risky company, situation reflected by the monthly average market risk premium, whose values revolves around 0. 52. Furthermore, Britvic PLC’s beta coefficient is of 1. 06.

The beta coefficient measures, according to Ross, the amount of systematic risk, one that influence a large number of assets, present in a particular risky asset, Britvic PLC’s shares in our case, relative to that in an average risky asset, FTSE 100’s shares. Both the monthly average market risk premium and the beta coefficient are relevant in further calculations for obtaining the monthly average cost of equity capital, as well as for obtaining the monthly expected return, which is going to be later analysed. Using the capital asset pricing model, the calculations resulted in a monthly cost of equity of 0. 7, meaning that for every pound invested in the business, the shareholders get 0. 87 pounds for bearing the systematic risk. All in all, before making an investment in Britvic PLC, a possible investor should take into consideration the minimum return from the investment, which has a value of 87p for each pound of the investment as described by the cost of equity, but as well the market to book ratios mirroring the amount of profit to be expected by the shareholder: cost of equity, average cost of capital, return an equity and return on assets.

Furthermore, the debt management policy is to be taken into account due to its implications for the share’s price, which are described by the company’s price to earnings ratio. As part of the Britvic’s debt management policy, gearing, that implies taxes exemptions due to „bank covenants” (Britvic PLC’s financial statement 2009 pg. 83), has resulted in a higher average price of preferred stocks, ? 286. 46.

7. Share price behaviour

As requested, a test for the market efficiency has been conducted and the results are to be assessed in the following part of the essay.

In order to analyse the flow of information within the market, Britvic’s share price was observed over a period of 60 months, from January 2005 until December 2009. It has resulted that the expected average return is of 0. 61. From the evaluation of the share price it has resulted that there are not more that 5 months of consecutive growth which means that the flow of information on UK’s market is efficient and it influences the share price. Therefore, we may state that the UK’s market is in a weak-form of efficiency.

As regarding to Britvic’s share price, the months of constant growth in the share price are the periods when Britvic PLC was in the news, either with the launch of a new product, like in 2006, when Drench was released to the market, or with the purchase of a new subsidiary, like in 2007, when the acquisitioned the Irish C&C Group PLC. Due to the fact that all events had an influence upon the share price of the company, it is to be relied upon the timeliness of the information provided by Britvic PLC. Due to a monthly standard deviation of 4. 5 of the share price, which means that the price revolves around a certain figure with no big increase from one month to another, it can also no be relied upon the accuracy of the financial statements of the company. The supervisory and legal enforcement system of UK’s market is to be taken into account when considering the possibility of an investment. According to the Journal of Investment Compliance, UK’s market is regulated from 2001 by the Financial Services Authority that acts as a market regulator and also an investigator and criminal prosecutor.

Its main concern is to set a healthy environment for the financial transaction involving UK’s companies), UK being now considered one of the most secure markets. So, it is highly recommendable to invest in Britvic PLC’s share. On one hand, the expected monthly average return is of 2. 09 meaning that if we take into consideration the past evolution of the share price, there are 50% chances for an investor to have an average monthly gain of 2% of what he has invested. On the other hand, an investment in Britvic PLC’s shares would not be recommendable for a client searching for massive and rapid gains.

The UK’s stock market is in a weak-form of efficiency, which means that any abnormal move of the price is by chance and there is no strategy to determine the future position of the price. When a test of the market efficiency , using a technical trading rule which triggers a sell signal at the end of trading on a 4th month whenever the price of the company’s share price risen consecutively for 3 months, was conducted . It has been discovered that UK’s market is influenced by the information received and, as a result, there are only 50% chances of predicting the shares price evolution.

These chances derive from a judgement of the past revolution, which enables certain expectance of repetitiveness in the future.

8. Portfolio effect

Last, but not least, all investors should take into account the possibility of investing in a portfolio comprising shares of different companies, in order to maximise the returns and minimise the risks. As requested, a portfolio comprising, Britvic PLC’s shares, with an average monthly return of 1. 32% and a standard deviation of 9. 47 and FTSE 100 index’s shares, with an average monthly return of 0. 29% and a standard deviation of 4. 2% is to be analysed. Considering the last correlation between the two assets, 0. 48, it may be stated that an investment in this portfolio is more advisable rather than an investment in Britvic PLC only due to the risk is lower and the return higher in the case of a portfolio. On the other hand, more options regarding the shares contained by a future portfolio should be reviewed, mainly because the correlation between Britvic PLC and FTSE 100 is not low enough to minimise risk and maximise return as much as possible and consequently a lower, even negative, correlation would be more desirable.

When assessing the profitability of a portfolio of two assets based on Marqovitz model, there are several cases with different amounts of wealth invested in the above mentioned companies. In all cases, the extra return is of 0. 10% and, therefore it is advisable to invest as to have the lowest values of the additional risk, which in this situation would be 0. 10%. Therefore, a portfolio with 10% wealth invested in Britvic PLC and 90% wealth invested in the FTSE 100 is the most efficient portfolio comprising the two assets.

The results of our test have been plotted to a graph reflecting the possibility frontier. In theory, as described by Jordan, the best shape of possibility frontier would be curved, mirroring a negative correlation between two assets. In our case, due to a sub unitary, but positive correlation, between FTSE 100 and Britvic PLC, the possibility curve has a slightly curved shape. The point on the curve, where the closest additional risk matches the additional return is defined as the starting point of the efficient frontier and from this point it is possible to invest in a portfolio comprising two given assets.

In our case, the possibility frontier matches the efficient frontier, meaning that it is profitable to place wealth in a portfolio comprising FTSE 100 and Britvic PLC’s shares distributed in any given proportions. Yet, the best profitability level is achieved at a stage where the additional risk is the lowest, 0. 10%, in our case, for the additional return of 0. 10%.

9. Concluding remarks

To conclude, it may be stated that Britvic PLC may be considered as a good possibility of investment, but the possibility spectrum should be broaden, as the best choice to be made.

Even though, Britvic PLC is an organisation with a good reputation and fame within British soft drinks industry, the present report underlines the idea of a thorough review of investment possibilities in order to achieve a maximum profit.

10. Bibliography

- Atrill Peter and McLaney Eddie, Accounting and finance for non-specialists, 6th edition, Prentice Hall, 2008

- Jordan D. Bradford, Ross A. Stephen and Westerfield W. Randolph, Fundamentals of Corporate Finance, McGraw-Hill Irwin, 2003

- Anderson Karen, Bates Chris, Staple George, “A New Millennium, A New Regulator?

- The Financial Services Authority’s Approach”, THE Journal of Investment Compliance, 2001 www. britvic. co. uk https://osiris. bvdep. com/version-20101011/cgi/template. dll http://uk. finance. yahoo. com/

11. Appendix

* Company overview | 2005| 2006| 2007| 2008| 2009| Average 2005-2008| Number of employees| 3,042| 2,895| 2,690| 3,153| 3,036| 2,945| Sales| 698,200| 677,900| 716,300| 926,500| 978,800| 754,725| Total assets| 492,400| 467,100| 694,600| 741,300| 853,500| 598,850| Market capitalisation | 494,000| 504,000| 702,000| 441,000| 762,000| 535,250| | | | | | | | Market-to-book ratio| 18. 75| 8. 74| 163. 1| 47. 43| 305. 09| 59. 53| Market value per share (? )| 2. 3| 2. 32| 3. 23| 2. 03| 3. 53| 2. 47| ? of shares outstanding (000)| 181,000| 217,282| 217,282| 217,282| 216,067| 208,212| | | | | | | | * Short-term assets management ratios | 2005| 2006| 2007| 2008| 2009| Average 2005-2008| Debtors (000)| 85,500| 87,200| 113,300| 132,200| 145,500| 104,550| Debtor days| 45| 47| 58| 52| 54| 50| | | | | | | | Trade creditors (000) | 83,100| 92,300| 110,800| 143,700| 187,000| 107,475| Cost of sales (000)| 224,600| 218,300| 241,200| 381,400| 403,100| 266,375| Creditor days| 135| 154| 168| 138| 169| 149| | | | | | | Stocks (000)| 37,900| 31,700| 45,300| 49,400| 52,900| 41,075| Stock days| 62| 53| 69| 47| 48| 58| Operating| cash cycle| -28. 76| -54| -41| -38| -67| -41| | * Liquidity ratios | 2005| 2006| 2007| 2008| 2009| Average 2005-2008| Current assets| 159,100| 151,100| 207,300| 222,200| 277,400| 184,925| Current liabilities| 166,300| 171,400| 223,200| 266,500| 303,300| 206,850| | | | | | | | Liquid current assets | 121,200| 119,400| 162,000| 172,800| 224,500| 143,850| | | | | | | | Current ratio| 0. 96| 0. 88| 0. 93| 0. 83| 0. 91| 0. 90| Quick ratio| 0. 3| 0. 70| 0. 73| 0. 65| 0. 74| 0. 70| * Profitability ratios | 2005| 2006| 2007| 2008| 2009| Average 2005-2008| Net profit before tax| 64,200| 36,500| 55,600| 51,800| 66,200| 52,025| Net profit after tax| 43,400| 24,200| 42,500| 31,800| 46,800| 35,475| Total equity| 22,200| 57,700| 4,300| 9,300| 2,500| 23,375| | | | | | | | Profit margin (%)| 9. 20| 5. 38| 7. 76| 5. 59| 6. 76| 6. 98| Return on total assets (%)| 13. 04| 7. 81| 8. 00| 6. 99| 7. 76| 8. 96| Return on equity (%)| 195. 50| 41. 94| 988. 37| 341. 94| 1872. 00| 391. 94| * Financial risk and return

Date| Share price| % return in shares| FTSE-100 Index| % return in FTSE 100 Shares| Treasury Bills Rates| Corporate debt rate| 1/12/2004| 241. 25| | 4814. 3| | 4. 68| 6. 24| 3/01/2005| 245| 1. 554404145| 4852. 3| 0. 789315165| 4. 66| 6. 24| 1/02/2005| 273. 12| 11. 47755102| 4968. 5| 2. 394740638| 4. 69| 6. 17| 1/03/2005| 267. 5| -2. 057703574| 4894. 4| -1. 491395793| 4. 77| 6. 27| 1/04/2005| 246. 25| -7. 943925234| 4801. 7| -1. 894001308| 4. 7| 6. 28| 2/05/2005| 285. 25| 15. 83756345| 4964| 3. 380052898| 4. 66| 6. 28| 1/06/2005| 279. 75| -1. 928133216| 5113. 2| 3. 005640612| 4. 62| 6. 6| 1/07/2005| 300| 7. 238605898| 5282. 3| 3. 307126653| 4. 46| 6. 11| 1/08/2005| 310. 5| 3. 5| 5296. 9| 0. 276394752| 4. 41| 6| 1/09/2005| 284. 5| -8. 373590982| 5477. 7| 3. 413317223| 4. 4| 5. 93| 3/10/2005| 297. 15| 4. 446397188| 5317. 3| -2. 928236304| 4. 4| 5. 88| 1/11/2005| 267. 25| -10. 06225812| 5423. 2| 1. 991612284| 4. 42| 5. 89| 1/12/2005| 246. 5| -7. 764265669| 5618. 8| 3. 606726656| 4. 43| 6. 13| 2/01/2006| 264. 75| 7. 403651116| 5760. 3| 2. 518331316| 4. 39| 6. 11| 1/02/2006| 276. 5| 4. 438149197| 5791. 5| 0. 541638456| 4. 38| 6. 14| 1/03/2006| 219. 75| -20. 5244123| 5964. 6| 2. 988862989| 4. | 6. 09| 3/04/2006| 220| 0. 113765643| 6023. 1| 0. 980786641| 4. 42| 6. 13| 1/05/2006| 203. 5| -7. 5| 5723. 8| -4. 969201906| 4. 5| 6. 13| 1/06/2006| 200| -1. 71990172| 5833. 4| 1. 914811838| 4. 54| 6. 13| 3/07/2006| 207. 5| 3. 75| 5928. 3| 1. 62683855| 4. 53| 6. 19| 1/08/2006| 219| 5. 542168675| 5906. 1| -0. 374474976| 4. 75| 6. 34| 1/09/2006| 231. 75| 5. 821917808| 5960. 8| 0. 926161088| 4. 84| 6. 35| 2/10/2006| 238. 5| 2. 912621359| 6129. 2| 2. 825124144| 4. 94| 6. 41| 1/11/2006| 234| -1. 886792453| 6048. 8| -1. 311753573| 5. 01| 6. 55| 1/12/2006| 294| 25. 64102564| 6220. 8| 2. 843539214| 5. 08| 6. 9| 1/01/2007| 300. 5| 2. 210884354| 6203. 1| -0. 284529321| 5. 3| 6. 64| 1/02/2007| 308. 5| 2. 662229617| 6171. 5| -0. 509422708| 5. 34| 6. 73| 1/03/2007| 333. 5| 8. 103727715| 6308| 2. 211779956| 5. 33| 6. 72| 2/04/2007| 347. 5| 4. 197901049| 6449. 2| 2. 238427394| 5. 43| 6. 86| 1/05/2007| 399| 14. 82014388| 6621. 4| 2. 670098617| 5. 55| 6. 85| 1/06/2007| 387. 25| -2. 944862155| 6607. 9| -0. 203884375| 5. 67| 6. 88| 2/07/2007| 322. 25| -16. 7850226| 6360. 1| -3. 75005675| 5. 77| 7. 1| 1/08/2007| 332| 3. 025601241| 6303. 3| -0. 893067719| 5. 79| 7. 08| 3/09/2007| 323| -2. 710843373| 6466. 8| 2. 593879397| 5. 9| 7. 2| 1/10/2007| 359| 11. 14551084| 6721. 6| 3. 940124946| 5. 61| 7. 15| 1/11/2007| 346. 5| -3. 48189415| 6432. 5| -4. 301059272| 5. 5| 7. 17| 3/12/2007| 346| -0. 144300144| 6456. 9| 0. 379323747| 5. 3| 7. 08| 1/01/2008| 308. 25| -10. 91040462| 5879. 8| -8. 937725534| 5. 12| 7. 02| 1/02/2008| 333| 8. 02919708| 5884. 3| 0. 076533215| 5. 02| 6. 84| 3/03/2008| 318. 75| -4. 279279279| 5702. 1| -3. 0963751| 4. 88| 6. 83| 1/04/2008| 332. 5| 4. 31372549| 6087. 3| 6. 755405903| 4. 83| 6. 77| 1/05/2008| 313| -5. 864661654| 6053. 5| -0. 555254382| 4. 95| 6. 72| 2/06/2008| 289. 5| -7. 50798722| 5625. 9| -7. 63682167| 5. 11| 6. 7| 1/07/2008| 222. 25| -23. 22970639| 5411. 9| -3. 803835831| 5. 08| 6. 67| 1/08/2008| 235| 5. 736782902| 5636. 6| 4. 151961418| 4. 95| 6. 65| 1/09/2008| 202. 75| -13. 72340426| 4902. 5| -13. 02380868| 4. 74| 6. 67| 1/10/2008| 227. 5| 12. 20715166| 4377. 3| -10. 71290158| 3. 68| 6. 63| 3/11/2008| 230. 5| 1. 318681319| 4288| -2. 040070363| 1. 99| 5. 57| 1/12/2008| 264. 25| 14. 64208243| 4434. 2| 3. 409514925| 1. 29| 4. 44| 2/01/2009| 230| -12. 96121097| 4149. 6| -6. 418294168| 0. 89| 3. 89| 2/02/2009| 230| 0| 3830. 1| -7. 699537305| 0. 72| 3. 09| 2/03/2009| 226| -1. 739130435| 3926. 1| 2. 06461972| 0. 6| 2. 72| 1/04/2009| 261. 75| 15. 81858407| 4243. 7| 8. 089452637| 0. 63| 2. 48| 1/05/2009| 276. 75| 5. 730659026| 4417. 9| 4. 104908453| 0. 53| 2. 4| 1/06/2009| 279| 0. 81300813| 4249. 2| -3. 818556328| 0. 5| 2. 35| 1/07/2009| 341| 22. 22222222| 4608. 4| 8. 453355926| 0. 44| 2. 26| 3/08/2009| 346. 6| 1. 642228739| 4908. 9| 6. 520701328| 0. 39| 2. 26| 1/09/2009| 352. 5| 1. 702250433| 5133. 9| 4. 583511581| 0. 38| 2. 23| 1/10/2009| 349| -0. 992907801| 5044. 5| -1. 741366213| 0. 44| 2. 2| 2/11/2009| 392. 6| 12. 49283668| 5190. 7| 2. 898205967| 0. 45| 2. 16| 1/12/2009| 408| 3. 922567499| 5412. | 4. 280732849| 0. 46| 2. 17| Monthly average| 286. 46| 1. 32| 5496. 71| 0. 29| 0. 33| 0. 47| Monthly standard deviation| 54. 48| 9. 47| 753. 95| 4. 32| 0. 53| 0. 48| Correlation coefficient| 0. 29| 1. 00| -0. 06| 0. 48| -0. 19| -0. 20| Beta coefficient| -| 1. 06| —| -| | | Average market risk premium implied by returns from 2005 to 2009| -| -| -0. 04| —| | | Annual average market risk premium| -| -| 6. 20| -| —| | Monthly average market risk premium| | | 0. 52| | | | Cost of equity (percent per month)| | | 0. 872| | | | Cost of equity (percent per annum)| | | 10. 46| | | | * Market efficiency

TEST ANALYSIS Predictd average return per month| 0. 61| | Predicted standard deviation| 4. 05| | standard error of mean| 0. 52| | count (n)| 60| | z-test statistic for a one tail test| 0. 12| | z test statistic at ? 95% confidence level| 1. 96| | Result| Not Significant| Market is weak-form Efficient| | | | | | | Bin (i. e. , class groups)| Frequency| Probability of occurrence| -5. 33| 1| 1. 67| -2. 02| 2| 3. 33| 1. 30| 49| 81. 67| 4. 61| 4| 6. 67| 7. 93| 3| 5. 00| 11. 24| 0| 0. 00| 14. 55| 0| 0. 00| More| 1| 1. 67| Total number of observation| 60| 100. 00| * Portfolio effect | Britvic PLC| FTSE100 index|

Average monthly return| 1. 32%| 0. 29%| | Monthly standard deviation| 9. 47%| 4. 32%| | | | | | Correlation between returns on Britvic PLC and FTSE 100 | | | 0. 48| Investment possibilities in a portfolio Wealth invested inBritvic PLC| Wealth invested in FTSE 100 index| Estimated Average return (%)| EstimatedStandard deviation (%)| Extra return(%)| Additional risk(%)| 0| 1| 0. 29%| 4. 32%| | | 0. 1| 0. 9| 0. 39%| 4. 42%| 0. 10%| 0. 10%| 0. 2| 0. 8| 0. 50%| 4. 67%| 0. 10%| 0. 25%| 0. 3| 0. 7| 0. 60%| 5. 05%| 0. 10%| 0. 38%| 0. 4| 0. 6| 0. 70%| 5. 52%| 0. 10%| 0. 48%| 0. 5| 0. 5| 0. 80%| 6. 07%| 0. 10%| 0. 55%| 0. | 0. 4| 0. 91%| 6. 69%| 0. 10%| 0. 61%| 0. 7| 0. 3| 1. 01%| 7. 34%| 0. 10%| 0. 65%| 0. 8| 0. 2| 1. 11%| 8. 03%| 0. 10%| 0. 69%| 0. 9| 0. 1| 1. 22%| 8. 74%| 0. 10%| 0. 71%| 1| 0| 1. 32%| 9. 47%| 0. 10%| 0. 73%| ——————————————–

[ 2 ]. Atrill Peter and McLaney Eddie

[ 3 ]. The average in sales for the 2005-2009 period is of ? 866762500 (for more details view the charts in the Appendix).

[ 4 ]. Jordan D. Bradford, Ross A. Stephen and Westerfield W. Randolph, Fundamentals of Corporate Finance

[ 5 ]. Even though the acquisition has physically taken place in 2009, it has been made public in 2010.

Britvic Plc Financial Analysis. (2017, Dec 02). Retrieved from https://paperap.com/paper-on-britvic-plc-financial-analysis-233/